About us

Properties in prime locations with stable income and enhancement potential

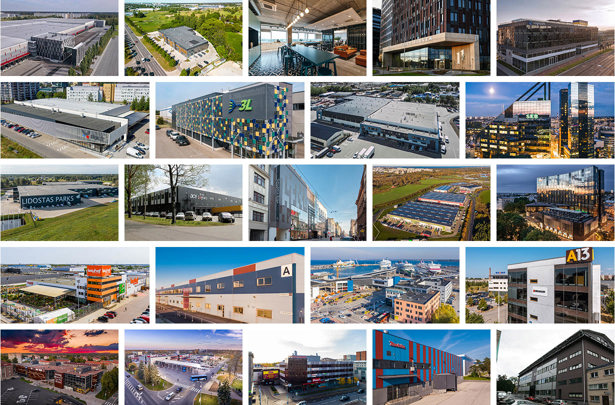

East Capital Real Estate offers investors excellent income-generating opportunities via its portfolios of high-quality, sustainable properties. These are backed by experienced fund managers with solid regional and market expertise and an established network of contacts. We manage three funds and one investment mandate, with a total property value of EUR 569 million, distributed across 23 properties (including 35 buildings) with a lettable area of 456 000 square metres.

How we add value to core investments

- Our team of 12 asset and property management specialists boast profound local knowledge, a strong network and a successful track record of delivering compelling returns over several market cycles.

- Our on-the-ground presence in Tallinn, Riga, Vilnius and Stockholm includes a proven track record of both management and development of commercial real estate.

- Our fully integrated platform includes asset sourcing, property and fund management.

- Our core profile features investments in strategic locations with access to good infrastructure and reduced volatility.

- We use a long-term investment approach, with diversification across various market segments and a focus on sound risk/return profiles.

- Our portfolios feature a combination of single- and multi-tenant properties in modern, energy-efficient buildings with good credit ratings and high occupancy rates.

- We offer a hands-on, proactive and tenant-centric management approach.

- We integrate ESG principles with a focus on best-in-class governance and sustainability practices.

- We strive for increased property attractiveness through improvements in tenant mix, property refurbishment, assessment of extension and redevelopment opportunities.

- We take a conservative approach to debt financing and leverage, with a focus on risk management.

Responsible investment and sustainable property management

Environmental responsibility and sustainable investment approaches to proactive property management are at the forefront of everything we do. We are committed to be a leader in our markets with a framework for proprietary ESG analysis and careful attention to health, environmental and energy-efficiency considerations.

East Capital Group

East Capital Real Estate is a part of East Capital Group, a global asset manager based in Sweden since 1997. Within East Capital Group you will find East Capital, Espiria, Adrigo and East Capital Real Estate. We offer a range of investment solutions within equities, fixed income securities, real estate, and alternatives. The essence of our business is not only to find attractive investment opportunities, but also to actively work to drive change, influencing industries around the world to become more sustainable.